US LLC Setup Guide for Non-US Residents

A practical guide to help non-US residents establish a single-member LLC in the United States.

Overview

This U.S. Company Setup Guide provides practical information for non-US residents looking to establish a single-member LLC in the United States. The process can seem intimidating, expensive, and complex when you're unfamiliar with it, often leading people to overpay for services or fall victim to scams. This guide is based on my personal experience of setting up a US LLC as a non-US resident. I've gone through the entire process myself, learned from my mistakes, and discovered ways to save money and time. I'm sharing this knowledge to help you avoid common pitfalls and make informed decisions.

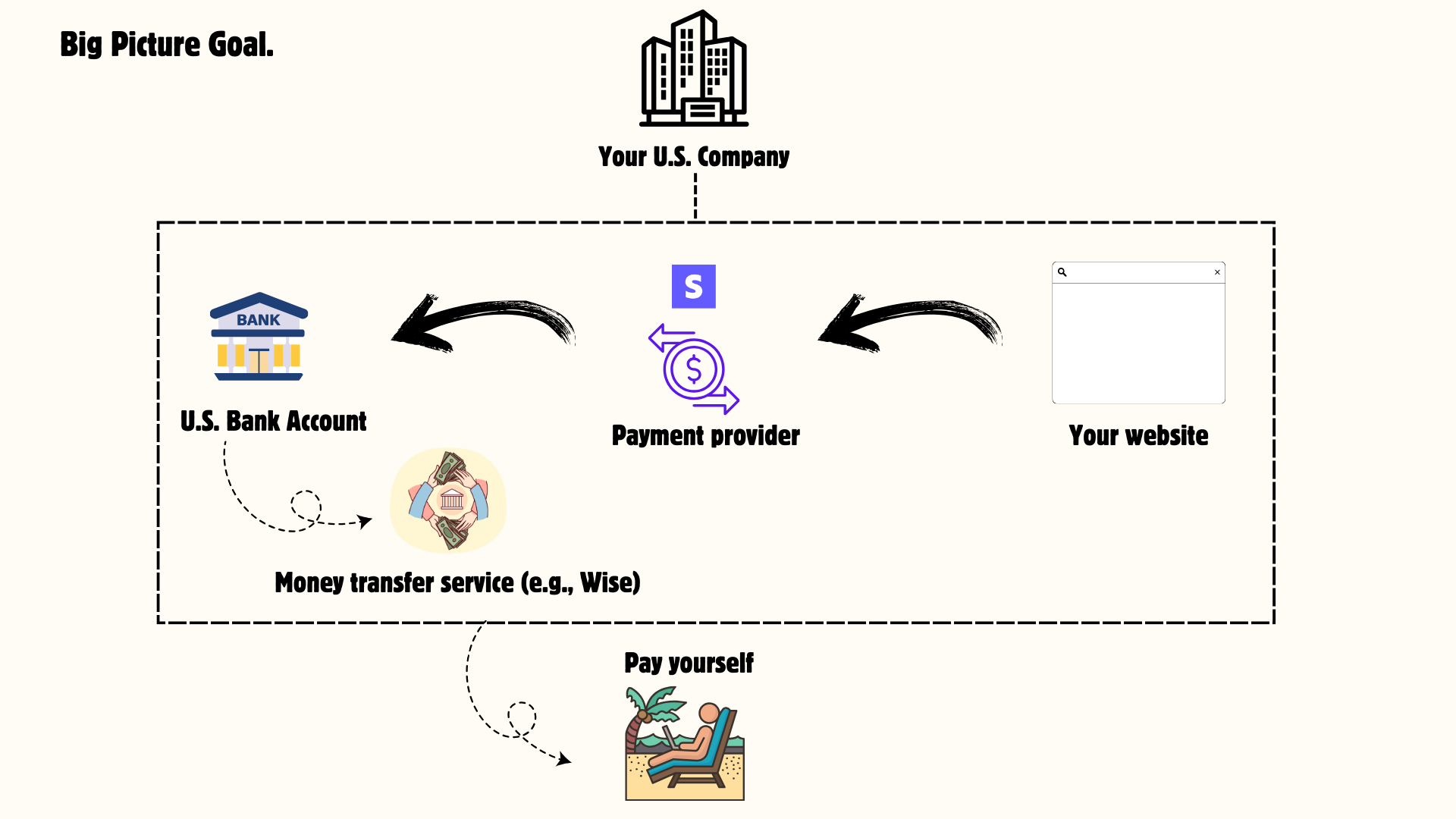

With this guide, I aim to demystify the process for you, helping you understand the legitimate steps required to form a US LLC, potentially saving you hundreds or even thousands of dollars in unnecessary fees. The below image is the business structure that we aim to setup. We want to do this setup in a most cheap and fast way possible. It took a lot of time and effort to build this guide, so I hope it covers a lot of the things you need to know.

This guide is available on GitHub

For the most up-to-date version and to suggest improvements, check out our GitHub repository. This ensures you always have access to the latest information and community insights.

Who is this guide for? This guide is specifically designed for:

- Non-US residents looking to establish a single-member LLC

- Online entrepreneurs selling digital products or services globally

- SaaS founders who need US payment processing capabilities

- Individuals without an existing "trader" business or ETBAS in the US

- Those looking to minimize formation and maintenance costs

Important Disclaimer

This is not legal, tax, or financial advice.

The information provided in this guide is for general informational purposes only. It is not intended to be a substitute for professional legal, tax, or financial advice. Always consult with qualified professionals regarding your specific circumstances.

Please note that while this guide aims to provide helpful and practical information, it may not cover every detail, and some information may become outdated or may not apply to your specific situation or even incorrect. Use it as a starting point to save time and money, but always verify details, and hopfully you find it helpful just like the below user did.

"Hey buddy if you made the guide .. thank you! Looks amazing and honestly I researched the past few weeks all over and you made a great perfect summary!"

—U.S. Company Setup Guide User

By using this guide, you acknowledge that:

- ZapStart or its company is not a law firm, tax advisor, or financial consultant

- Business regulations vary by state and change over time

- Your specific situation may require different approaches

- You should read and understand all terms of service for any platforms you use

- You take full responsibility for your business decisions

Benefits of a US LLC for Online Businesses

For non-US residents running online businesses, establishing a US-based LLC provides several crucial advantages:

Payment Processing Access

Access premium payment processors like Stripe and PayPal with full functionality. Many payment platforms provide limited features or higher fees for businesses registered outside the US.

Limited Liability Protection

Shield your personal assets from business liabilities and potential legal issues. This separation is crucial for online businesses that serve customers worldwide.

Enhanced Business Credibility

A US business presence signals stability and credibility to customers, partners, and investors worldwide, potentially increasing conversion rates and opening partnership opportunities.

Tax Efficiency

Single-member LLCs provide pass-through taxation and can be structured to optimize international tax situations. Non-resident aliens typically only pay US taxes on US-sourced income. Means that mostly you won't have to pay taxes on your income in the US.

Banking & Financial Services

Gain access to US business banking options, payment processors, and financial tools that may not be available to businesses in your home country.

Global Market Access

Remove geographical barriers to selling products and services globally, with simplified payment collection from customers worldwide through established US payment systems.

Expected Cost & Time Comparison

Setting up a U.S. company as a non-U.S. resident can be costly and time-consuming, especially if you're unfamiliar with the process. Here's what you get using our guide:

With U.S. Company (LLC) Setup Guide

Cost Breakdown:

- Using this guide can save you $550-1,900+ in setup costs. The total first-year cost with our guide is approximately $400-450, compared to $950-1,900+ without it if accepting the services of a registered agent. Many registered agents charge premium fees for services you can do yourself with proper guidance. Our guide provides the most cost-effective approach (for my knowledge), while still giving you the option to hire service providers if you prefer.

Time Required:

- With our step-by-step guide, you can complete the entire process in 2-4 weeks (form the company and bank accounts). The guide eliminates extensive research time, simplifies decision-making, and provides clear instructions for each step. We've already done the testing and research so you don't have to spend months figuring out the most efficient approach, saving 5-8 weeks.

U.S. Tax Exemptions for Non-US Residents

As a non-US resident with a single-member LLC in the United States, you may qualify for significant tax advantages. Many non-US residents don't need to pay U.S. federal income tax on their business income if they meet these requirements:

When You Don't Pay U.S. Income Tax

- No U.S. physical presence – You don't operate your business while physically present in the U.S.

- Effectively Connected Income (ECI) – Your income isn't effectively connected with a U.S. trade or business.

- Digital products/services – Your business primarily sells digital products, SaaS, or services delivered electronically.

- No U.S. office/employees – You don't maintain a U.S. office or have U.S.-based employees.

- And other things that you're most likely not doing, more guidance about that in the guide.

Tax obligations in your home country remain

You'll likely still need to report and pay taxes in your country of residence. Many countries have worldwide taxation systems. Always consult with a qualified tax professional familiar with both U.S. and your local tax laws.

Note: You'll still need to file an annual information return (forms), more about that in the guide.

Frequently Asked Questions

Do I need to visit the US to form an LLC?

No, the LLC formation process can typically be completed entirely online. However, some banks may require an in-person visit to open a business account. Fortunately, there are now several digital banking options that work well for non-US residents.

Do I need a US address to form an LLC?

You need a registered agent with a physical address in the state of formation, but this can be a service provider rather than your personal address. Don't worry, we will handle this throughout the guide.

Can I open a US bank account as a non-resident?

Yes, but policies vary by bank. Some require in-person visits, while others work with non-residents remotely. Several fintech solutions also offer viable alternatives to traditional banking. Our full guide includes specific recommendations.

Geographic restrictions apply

This guide includes setting up accounts with Wise and Mercury banking services. Please note that these services have geographic restrictions and do not support users from certain countries. Before purchasing -if the guide is critical for your business-, verify that your country is not on the restricted list by checking Mercury's and Wise's supported countries pages.

What's the difference between an LLC and a C-Corporation?

An LLC offers pass-through taxation and simpler compliance requirements, while a C-Corporation faces double taxation but may be preferred for raising venture capital. For most online businesses and SaaS startups in the early stages, an LLC is the simpler and more tax-efficient choice.

How does ZapStart help after I form my LLC?

ZapStart provides the technical infrastructure you need to launch your online business or SaaS product quickly. Our boilerplate includes user authentication, payment processing, subscription management, analytics, and pre-built components—everything you need to start generating revenue without months of development work.

Ready to Launch Your Online Business?

Form your LLC with our guide and build your product with our boilerplate—the fastest path from idea to revenue-generating business.